Exclusive Report: Augmenting the Underwriter

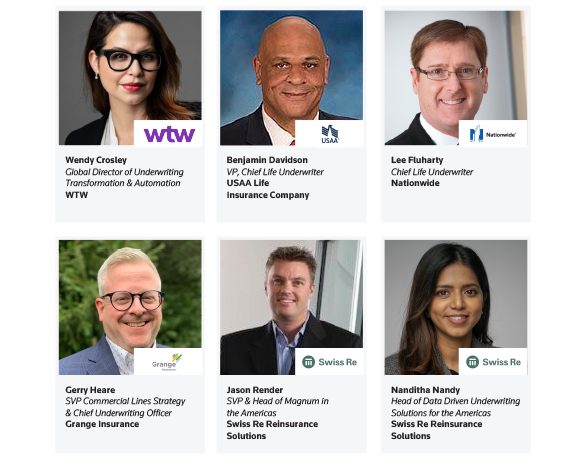

Featuring actionable insights on Underwriting Automation from Grange Insurance, WTW, Nationwide, USAA & Swiss Re Reinsurance Solutions

Digitalization has touched every part of insurance, and underwriting is no exception. Rising costs and talent shortages hamper advancement efforts, but carriers simply must embrace technology or risk getting left behind. So, what’s the next step on the long road to progress? Automating your underwriting processes has the potential to not only enhance efficiency and thus promote profitability, but also to significantly improve your customers’ experience and open new doors for advanced data analytics.

That’s why we asked leading carriers to share their insights on the benefits of the new age of underwriting.

The report outlines how to:

- Unlock your employees’ full potential: Reduce underwriters’ workloads and improve their job satisfaction with automated data collection and case handling.

- Revolutionize your customers’ experience: Cut waiting times with increased decision velocity to improve your reputation and reduce the proportion of clients dropping out of your purchase process.

- Enter a new league of data analytics: Identify and act upon insights from automation data to optimize your risk forecasting, address problematic customer journey stages and improve your operations at every level.

Key insights to look forward to:

- Gerry Heare, Chief Underwriting & Strategy Officer, Grange Insurance said: “[Automated underwriting] generates more revenue without increasing our tolerance for risk.”

- Wendy Crosley, Global Director of Underwriting Automation and Transformation, WTW said: “I’ve come to realize that the success of these types of efforts relies heavily on effective change management. If that fails, you're going to struggle to actually realize all of the benefits of the technology.”

- Ben Davidson, Vice President, Chief Life Underwriter, USAA said: “As innovation and technology continue to advance, the majority of the limitations we are currently facing should be eliminated in the next decade or so.”

- Lee Fluharty, Chief Underwriter, Nationwide said: “There has to be the ability to explain how all the information you brought together derives this decision, and then you need to be able to explain that back to your customer as to why they ultimately ended up in whatever risk category they are in.”

- Jason Render, Head of Magnum Americas, Swiss Re Reinsurance Solutions said: “The biggest benefit [of automation] is that it keeps you relevant. If you're not automating right now or going digital, I think you're getting beaten by the competition.”

Kind regards,

Alexandra

Reuters Events is part of Reuters News & Media Ltd, 5 Canada Square, Canary Wharf, London, E14 5AQ. Registered in England and Wales: 2505735.